Global battery pack prices are decreasing. Battery pack prices have decreased by more than $20 compared to last year. The prices of major raw materials and changes in manufacturers’ production plans were cited as reasons for the decline in battery prices. The price of a battery pack is expected to hit $80 in 2030.

Battery pack price

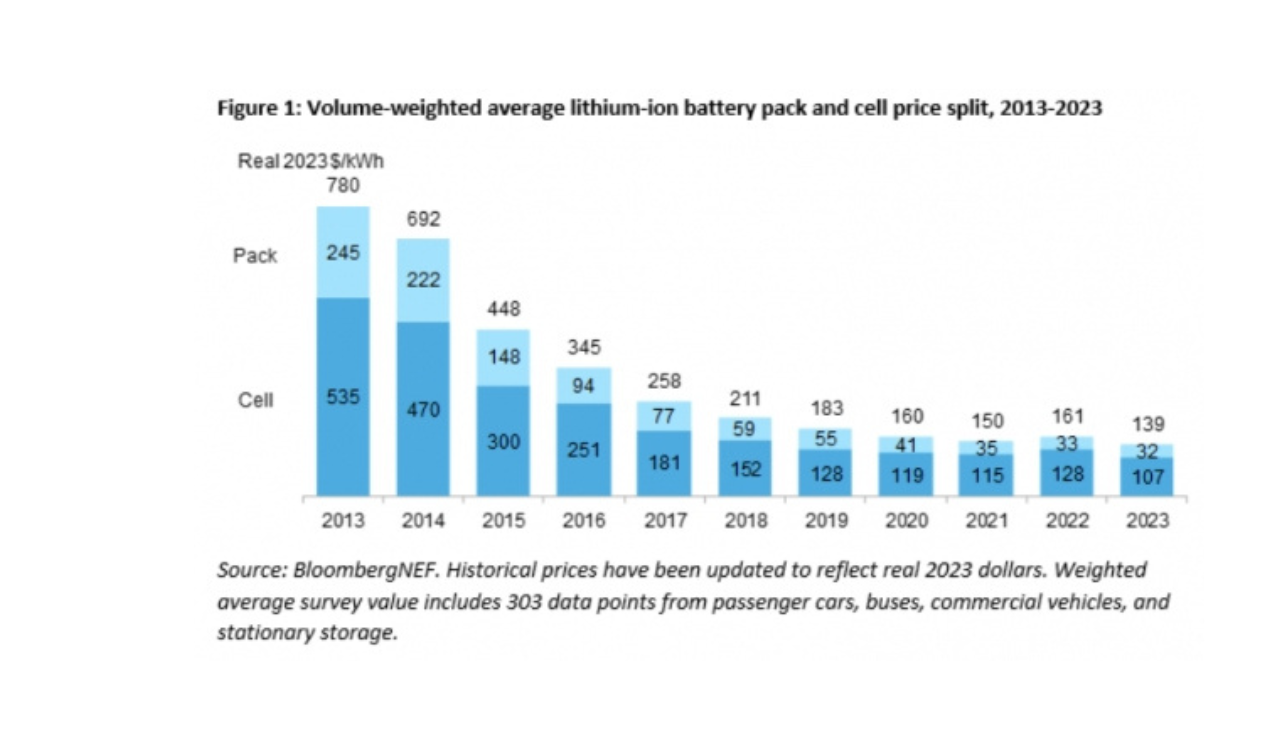

According to market research firm BNEF, the price of lithium-ion battery packs this year hit $139 per 1kWh, down 14% from the previous year. Declining prices of key raw materials such as lithium, nickel, and cobalt, as well as battery manufacturers’ localization goals and changes in production plans, affected battery prices. BNEF predicted that “the decline in battery prices will continue and reach $80 in 2030.”

Lithium, nickel, cobalt, etc. are key minerals needed for cathode materials and have a significant impact on prices. Since cathode materials account for 40% of battery costs, a decline in core mineral prices will inevitably lead to a decline in battery prices.

In particular, the price of lithium hydroxide, which is mainly used in electric vehicle batteries, is plummeting. According to a report by the Australian Department of Industry, Science, Energy and Resources, the price per ton of lithium hydroxide is falling from $69,370 last year to $40,000 this year and $30,000 in 2025. As a result, the price of battery packs is expected to continue to decrease, from $133 in 2024 to $113 in 2025, based on 1 kWh, and to $80 in 2030.

Changes in production goals by major battery manufacturers also had an impact. By region, in China, price competition was fierce as the number of battery manufacturing competitors in China increased. The battery pack price in China was the lowest at $126.

Battery pack prices in the U.S. and Europe were 11% and 20% higher than in China, respectively. However, prices are expected to fall as battery manufacturing is being localized, especially in the U.S. and Europe.

“Large markets such as the U.S. and Europe are strengthening local cell manufacturing,” said Yayoi Sekine, head of energy storage at BNEF. “Production incentives, localization efforts, and strengthening regulations on key minerals will have an impact on battery prices.”.

BNEF explained that some manufacturers have lowered their factory operation rates due to slowing demand in the electric vehicle market. The three domestic battery companies also saw a decrease in their factory operation rates.

LG Energy Solution’s production capacity and production performance expanded compared to the same period last year, but its operation rate slightly decreased. The operating rate in the third quarter was 72.9%.

SK On had the smallest amount of change. Compared to the operating rate in the first quarter, the operating rate in the third quarter decreased by 0.4% to 94.9%.

The operation rate of Samsung SDI’s energy solutions division decreased by 11% compared to the same period last year, reaching 77%. However, the energy solution sector includes not only batteries for electric vehicles but also small batteries, so it is understood that the operation rate has decreased due to the slowdown in the small battery market.

Regarding future battery pack prices, BNEF said, “Next-generation cathode materials such as silicon and lithium metal cathode materials and solid electrolytes, as well as cell manufacturing processes, will lead to a decrease in battery prices.”