VinFast claimed rising Q3 revenue, EV deliveries, and vehicle sales on Thursday. While most of the recorded growth is because of the sales to a related company. The Vietnamese automaker EV deliveries hit 10,027 in Q3, which records an up of 5.2% from the second quarter’s 9,https://localtrendingnews.com/vinfasts-ev-deliveries-grew-over-400-in-q2/535. The company mentioned that it began to observe a rise in sales in North America, especially Canada.

VinFast founder Pham Nhat Vuong said to investors on an analyst call that around 60% of sales are due to Green and Smart Mobility. It is to be noted GSM is a rental and taxi company that was created by Vingroup, VinFast’s parent company. The company stepped onto this in March, with the motive to expand the use of its electric cars and scooters throughout Vietnam.

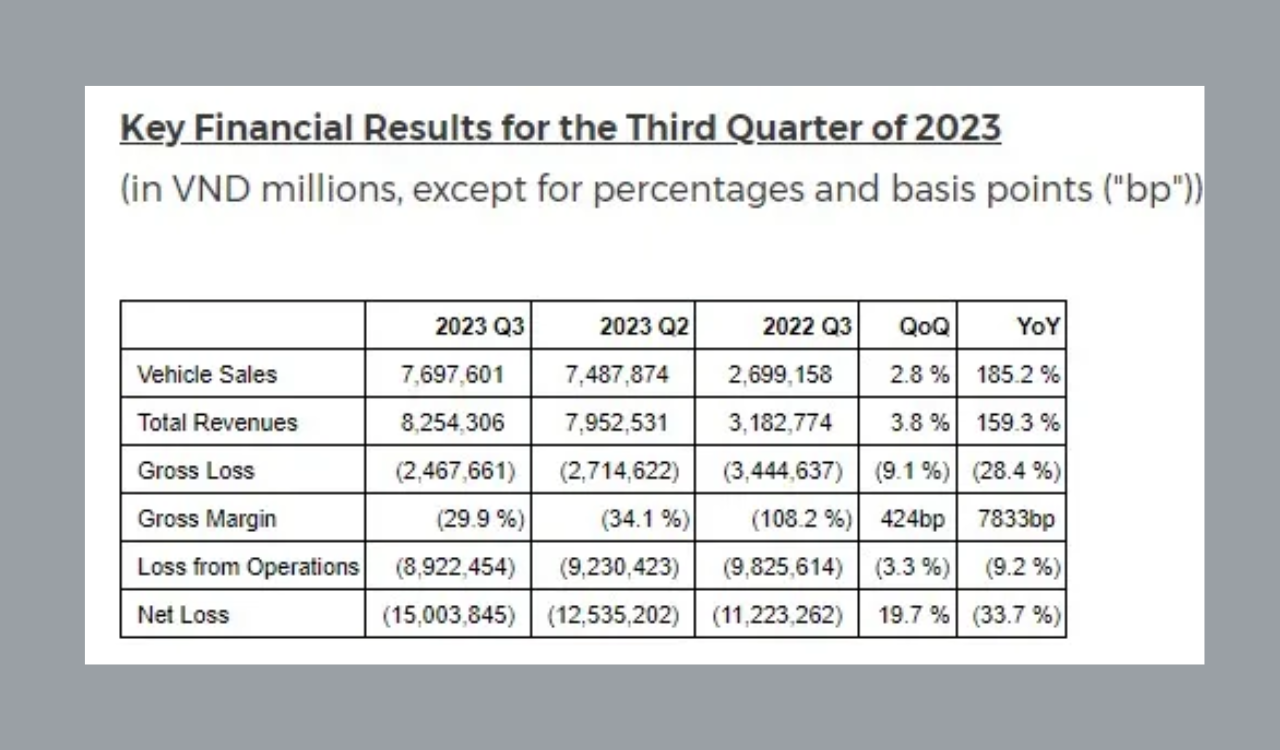

The associated company has been responsible for approximately two-thirds of VinFast’s sales over the past two quarters. VinFast disclosed Q3 vehicle sales that were e $319.5 million, up 2.8% from Q2. The company revenue increased by 3.8% quarter over quarter to $342.7 million. This is majorly from vehicle sales, the company also sells electric scooters.

VinFast EV deliveries up in Q3

The EV maker’s gross losses did decrease by 9.1% from Q2 to $102.4 million. However, net losses continued rising. VinFast’s losses reached $622.9 million, up almost 20% from last quarter.

VinFast finished the third quarter with $131 million in cash and equivalents. The company stated recently it believes “it has sufficient runway to grow in the coming years and will continue to look for opportunities to strengthen its balance sheet.”

On the other side, Vuong has promised to inject $2.5 billion into the company via loans and grants in order to raise growth. The automaker anticipated to get up to $1.2 billion in grants over the next six months.

The company also reaffirmed its target of delivering between n 40,000 and 50,000 vehicles this year. While only 21,342 EVs delivered to date, the EV maker will need to more than double output over the coming quarter in order to achieve its goal. Vuong stated on the earnings call that he is “confident” vehicle sales will increase over the next quarter by mentioning new models such as the new VF 6 and seasonality in Vietnam.

In addition to this, the automaker became a sensation after its explosive IPO in the US. They also revealed climb-up prices to an intraday high of $93 on August 28, with a market cap of over $200 billion. When it makes a comparison then VinFast was worth more Ford ($47 billion), GM ($41 billion), Volkswagen ($57 billion), Stellantis ($18 billion), and Rivian ($17 billion) combined.